Introduction

Project management has gained popularity in the current competitive market. The world is increasingly becoming competitive, and firms are under great pressure to improve their performance to sustain the competition. According to Nagarajan (2005, p. 117), firms are under intense pressure to come up with creative projects that would help give them a competitive advantage over their competitors in the market. This scholar says that creating a competitive advantage requires a firm to be able to create new projects at regular intervals. This will help ensure that the competitors are always kept a step behind the firm. To achieve this, a firm must have a deep understanding of project management. In every project that a firm starts, there is always a heavy investment that is committed to ensuring that it succeeds. A firm will need to commit finances, labor, and time to such projects. Their success is, therefore, something that should be of utmost importance to all the stakeholders involved in it.

To achieve this success, the management needs to understand all the stages of the project life cycle. This will help in determining which activity should be carried out at every stage of the project. The overall success of a project will always be determined by the success of the firm at every stage of its life cycle. Project planning will help define the entire path of the project. With an appropriate project plan, it is always more likely to expect success in the entire project.

Purpose of the Project

According to Nagarajan (2005, p. 84), a project should have a clear purpose that explains the justification of why it should be undertaken. This scholar says that before a project is approved within the relevant authority, the management would demand to know its clear purpose and how this will help the firm achieve its overall goal. In this project, the focus is on mobile money transfer within Deutsche Bank in its UK branches. The project is focused on using advanced technology in the banking sector to make life easier for the customers of this bank. For this purpose, the project management team will develop software that will help customers of this firm access their bank account through their mobile phones. This will be an improvement on the previous successful project where the bank developed software to allow its customers to access their accounts using internet-enabled computers.

In this strategy, the management will ensure that customers who would want this service register and all their details are entered into the new system. Using their mobile phone, customers will be able to make money transfers from their account to various other accounts, make payments or receive alerts whenever any transaction is made. The project will be called “The Mobile Money” given its nature. Moreover, the project will help customers of this firm to have increased access to their accounts. They would not need to travel to the bank or the Automated Teller Machines to make their payments. With this, the project management hopes that there shall be increased satisfaction for the customers and this will attract more customers.

Aim and Objectives of the Project

According to Nagarajan (2005, p. 76), a project should have clearly stated aims and objectives. This will help point the direction that should be taken when implementing the project. The aim of a project is the broader vision that a firm plans to achieve, while objectives are midterm goals set within a specific period and can be adjusted frequently as the firm advances. The aim of the project “The Mobile Money” is to develop a mobile money transfer system that will enable customers of Deutsche Bank to make a withdrawal of their money or send money to other accounts using their mobile phone. However, the ultimate aim of this project is to develop a mobile money transfer feature that will allow customers of this bank to manage their accounts using their mobile phones. With this, the project management team hopes to increase the level of satisfaction of customers of this firm. This project should be able to achieve this objective if the implementation is done properly. As such, the following should be the guiding objectives.

- To ensure that customers of this bank have access to their money whenever they need it irrespective of their location.

- To ensure that this new system functions without any form of threat to the accounts of the customers.

- Both the bank and the customers should not be made vulnerable to fraudsters upon implementation of this project.

- To ensure that this new system functions properly without any difficulty to the users.

- To increase the level of customer satisfaction and hence attract more customers to this bank by providing this value-added feature.

According to Murch (2004, p. 28), achieving the set objectives in a project always depends on the level of competence of the project members, their determination, and experience in that particular field. When selecting members of the project, it is important to consider these factors. It is only through this that the management can have a guarantee that the project will be a success.

Stages of the Project Life Cycle

According to Mouton (1990, p. 68), the project life cycle has four stages, with the fifth stage which is the completion, being a silent stage in most projects. This scholar says that many scholars have defined these four stages differently, but basically, they mean the same thing. In this project, the management team should ensure that the following stages are followed carefully because the overall success of the project will always depend on the success of each stage. Iles and Cranfield (2004, p. 8) observe that it is important to monitor changes taking place at every stage.

The first stage is the project initiation stage. In a firm, the management will always receive various proposals for possible projects. The initiation of the project can come up from various employees in their respective departments. The projects will be taken to the relevant department for approval. Upon approval, the management will then select members who will participate in the project, headed by the project manager. The project manager will work closely with the project coordinator.

The next stage is the assessment and planning stage. As Letavec (2006, p. 39) says, project planning is a very important stage in ensuring the success of a project. This scholar says that at this stage, the project members will define the goals and objectives of the firm. They will clearly state what the project should achieve within a specific period. The project management team must determine the feasibility of the project. The feasibility study will help determine whether the project is worth the expenditure that it will consume. The management will then determine an action plan. The action plan will clearly state what is to be achieved within a specified time. The stage will also involve determining the parameters of the success of the project.

The next phase is the implementation of the project. This is a very important stage, and as Kousholt (2007, p. 47) observes, requires a lot of determination from all the members. Every member of the group should have a clear duty to perform within the project. According to the research done by Delving (2006, p. 79), it is a fact that team spirit is very important in every project that a firm starts. The management should ensure that during the process of implementation, all the project members should work as a single unit. Kanda (2011, p. 36) says that this should be done in a manner that would not encourage redundancy. Working as a team does not necessarily mean doing the same thing. Project members can engage in different activities but feel that they are working together because they may be working within the same premise. Team spirit can also be promoted by just creating the sense that all the employees would be working towards achieving the same goal. The implementation stage should encourage the use of skills and talents that some of the members could be having. Giannantonio and Hanson (2011, p. 10) say that skills and talents can help in improving the chances of success in a project. During the implementation phase, the project manager should work closely with project members and the project coordinators to ensure that all the activities of the project are in line with the overall objective of the firm. The project coordinator will be the direct link between the project and the top management. The project manager will be reporting to the project coordinator who will then communicate with the top management. All the resources needed for the project shall be channeled through the project coordinator but will be controlled by the project manager (Davida 2008, p. 89).

The next phase in project management is monitoring and evaluation. According to Coulter (2009, p. 57), many financial institutions have lost billions of pounds due to dubious projects that were never monitored properly by the relevant authorities. For this matter, it is important to ensure that all the projects that are initiated are closely monitored to determine whether they are in line with the overall objectives of the firm. Monitoring and evaluation are mostly done by the management. The project manager will monitor and evaluate the success at every level of the project and report to the project coordinator. The project coordinator is also expected to conduct an independent evaluation of the project from time to time to ensure that it is in line with the vision and mission of the firm. The top management will finally evaluate internal auditors or the service can even be outsourced. Such companies as Ernst & Young or PWC are known to offer excellent services when it comes to evaluation. They can help the firm determine if the project is running within the expectation. Deutsche Bank can avoid any unnecessary losses when the evaluation is done frequently and appropriately on the project. Guthrie (2002, p. 67) says that frequent evaluation helps in the identification of loopholes early enough to allow for precautionary measures to be taken within a project.

When it is proven to be a good project that can help this firm realize its vision in a better way, the management will adopt it. Adoption will mean that the prototype that was developed during the implementation stage will now be used in the entire firm. At this stage, the management of Deutsche Bank will be certain that the project will be of benefit to the firm both in the short run and long run. The strategy will, therefore, be unveiled.

Preparation of a Project Plan

The Stakeholders’ Needs

According to Cooper (2009, p. 98), every project comes with several expectations that should be achieved within a specified time. This scholar says that every stakeholder has specific needs that should be fulfilled by the project. In this project, there are several needs that different stakeholders wish to be fulfilled upon completion of a project. The first stakeholder is the customer. From this project, the customer needs a service that will help make it easier to access their account and finances which are at the bank. The project should fulfill this need. The second stakeholders are the shareholders or the investors who need increased profits for their investment. The third stakeholder is the management which hopes that the project would result in business expansion. Various departments within this bank also form another section of the stakeholders. The marketing department expects increased market share, the finance will need an increased cash inflow while the insurance unit expects a reduced risk. The success of this project will meet the needs of these stakeholders. Clark (2000, p. 89) emphasizes the need to incorporate all the stakeholders in the activities of a project.

Justification of the Project Implementation Method

In this research, the participatory method of project implementation was the most appropriate. According to Binder (2007, p. 89), the participatory method is always important in ensuring that all the members of the project participate in the project implementation stage. For instance, the software development team will acquire the equipment and expertise required to make the mobile-enabled banking application. At the same time, the marketing team will begin to promote this feature to create awareness of the product before its launch. In this project, the marketing process must begin along with the software development process as the project must be completed in a short time frame i.e. four months. As evaluated in the assessment and planning stage of the project, the marketing and promotion process of such software must begin at the earliest to ensure maximum awareness upon the launch of the service. Moreover, the team responsible for ensuring safety and security within the software will begin to develop security tools and the legal terms of software usage. Therefore, the participative method of implementation will help in realizing the best of the benefits for the project as a whole. However, one must note that some of the stages of a project are interdependent and a delay in one stage could delay the stages which are dependent on that particular stage and in turn cause delay to the whole project. For instance, a certain project may require the marketing team to first analyze the potential market base, and only then the scope of the project and the investment required could be determined. The advantage for Deutsche Bank in this project is that the software, once developed, can serve any number of customers willing to register for the same. Thus most of the activities within the implementation stage as discussed above are not interdependent ensuring speedy completion of the project. Only minor tasks such as registering the application with various mobile application providers and the development of a support team would begin once the security software is developed and ready for the market. These tasks can only be delayed if the software is not developed within the time allotted to the development team.

Methods of Monitoring Project Progress

Project progress can be monitored using various methods. One of the most common methods of monitoring the progress of the project is to use internal structures. As discussed above, monitoring of the progress can be done by the project coordinator who will assess how well the project is fulfilling what it was supposed to fulfill at every stage of the project. Another appropriate strategy can be to outsource experts in this field who will conduct a comprehensive analysis of the project based on what it was expected to achieve. However, in this project, an internal analysis would be sufficient and effective enough to ensure the success of the project. The project manager will create a Gant Chart and a PERT chart to monitor the project progress. The team will then report to the management on how well the project is achieving its intended objectives.

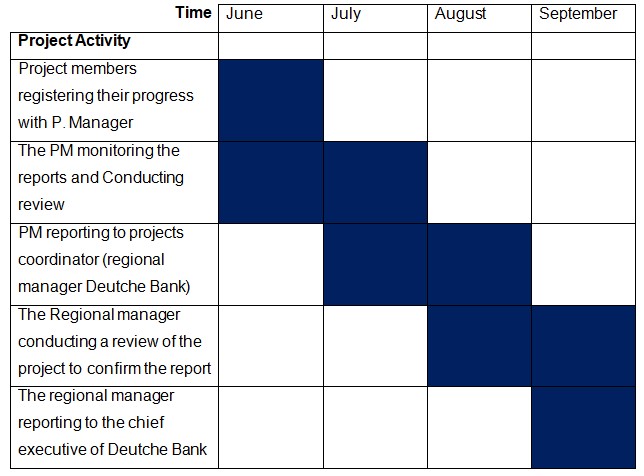

Gantt Chart

The following Gantt chart is an example that shows the activities that will be carried out, officials who will be responsible, and the time for each activity. Project members will register their projects with the project manager from June to July after which he will analyze and evaluate up to August. From July to September, the project manager will be reporting to the projects coordinator (regional manager Deutsche Bank). The Regional Manager will conduct a review of the project to confirm the report from August to and September. The regional manager will report to the chief executive of Deutsche Bank in September.

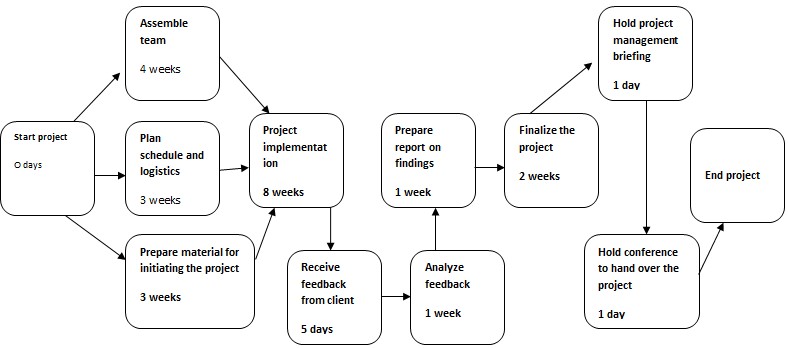

PERT Chart

A PERT chart provides an effective presentation of the schedule adopted by a project. The schedule is divided into different tasks that are sequenced. The chart also provides information on which tasks are to be performed and at what stage of project implementation. The chart below demonstrates how the above project will be executed, explanation follows.

Based on the project life cycle described in the PERT chart above, this project implementation will take 8 weeks. However, before the implementation, the team will assemble (4 weeks), plan and assemble logistics (3 weeks), and prepare material to initiate the project. The implementing team will take 5 days to receive feedback from the client, carry out analysis of feedback for 1 week and take another week to prepare a report on findings. The team will then finalize the project in 1 week, hold a project management briefing for 1 day and hold a conference in 1 day to hand over the completed project. Therefore, the project management team will take a total of 21 weeks and 2 days to go through the cycle of project implementation.

Dealing with Problems that May Negatively Impact the Project’s Progress

In the process of implementing a project, problems would always rise. When such cases arise, the management is forced to come up with a solution that will help in dealing with the problem. One such problem that can arise when implementing this project is when employees start giving fake reports to please the management. This is very dangerous because the hope and subsequent responsibility and finance that will be committed to the project will be lost. To deal with this problem, the management should conduct regular evaluations of the project and discourage unfaithfulness among employees. Another problem may arise when there is a lack of corporation or proper coordination of the employees who form the team implementing the project. This project by Deutsche Bank can realize its success when employees working on it are coordinated, they understand the requirements of the project and can work as a team in realizing the objectives of the project.

The importance of achieving project outcomes within agreed timescales, resources, and budgets

When planning a project, the management will always determine the amount of money that should be spent on the project, other resources, and the duration upon which the project should be completed. Woo (2012, p. 130) says that organizations should manage resources in a way that will give the highest returns within the expected time.

It is, therefore, very important to ensure that a project is completed within the agreed timescales, resources, and budget. It is through this that the real value of the project shall be realized. For instance, if the software by Deutsche Bank is not developed in the given time, it may hamper the success of the project. Another competitor could also be working on a similar project and would gain a competitive edge if their software or service is launched in the market before Deutsche Bank as one of the aims of this project is to gain a competitive edge by providing a new type of service to the market.

Method for Reporting and Reviewing Outcomes for Projects

There should be a clear method of reporting and reviewing the outcomes of a project (Andrzej & Buchaman 2007, p. 48). For this project, the most appropriate method of reporting the project should be the linear method. In this method, every project member will report to the project manager over their respective tasks. The project manager will compile this report to help determine the level of success of the project. The project manager will then prepare a detailed report and give it to the projects coordinator. The project coordinator will verify this report and then send it to the top management. The top management will approve and make a publication of the report at a preferred time. In this case, the top management of Deutsche Bank will be able to review the progress of the project at any time they wish to. The regional manager of this bank will act as the project coordinator, and he would need to report to the chief executive officer and other senior managers of Deutsche Bank on the progress of this firm.

Conclusion

As shown from the above discussion, project management is one of the most important factors that will always determine the success or failure of a project that is initiated within a firm. Deutsche Bank is operating in a very competitive market where there are other strong competitors. Coming up with this project will help it achieve its objectives of being the leading bank in the region. The management should therefore manage the project life cycle properly if it expects good returns. Keen attention should be given to project planning and implementation.

References

Andrzej, A &Buchaman, A., 2007, Organizational Behavior, London, UK: Prentice Hall.

Binder, J., 2007, Global project management: communication, collaboration and management across borders, Aldershot, Gower.

Clark, C., 2000, Differences between public relations and corporate social responsibility: an analysis, Public Relations Review, vol. 26, no. 3, pp. 363-80.

Cooper, R., 2009, Portfolio management for new products, Perseus, Cambridge.

Coulter, M., 2009, Strategic Management in Action, Pearson Higher Education, New York.

Davida, F., 2008, Strategic Management: Concepts, Pearson Higher Education, New York.

Delving, A., 2006, Research methods: planning, conducting and presenting research, Wadsworth, Belmont.

Giannantonio, C. & Hanson, A., 2011, Frederick Winslow Taylor: Reflections on the Relevance of The Principles of Scientific Management 100 Years Later, Journal of Business and Management, vol. 17, no. 1, pp. 7-11. Web.

Guthrie, J., 2002, High-involvement work practices, turnover, and productivity: Evidence from New Zealand, The Academy of Management Journal, vol. 44, no. 1, pp. 180-190

Iles, V &Cranfield, S., 2004, Managing Change in the NHS: Developing Change Management Skills: A Resource for Health Care Professionals And Managers. Web.

Kanda, A., 2011, Project management: A life cycle approach, PHI Learning Private Limited, New Delhi.

Kousholt, B., 2007, Project management: Theory and practice, NytTekniskForlag, New York.

Letavec, C., 2006, The program management office: establishing, managing and growing the value of a PMO, Ross Publishers, Florida.

Mouton, J., 1990, Basicconcepts in the methodology of the social science, Hunan Sciences Research Council, Pretoria.

Murch, R., 2004, Project management: Best practices for IT professionals, Prentice Hall PTR, Upper Saddle River.

Nagarajan, K., 2005, Project management, New Age International, New Delhi.

Woo, L., 2012, High Performance Work Systems, Person-Organization Fit and Organizational Outcomes, Journal of Business Administration Research vol. 1, no. 2, pp. 129-134. Web.