Introduction

This section of the report discusses research methodology used in obtaining results of this study. The section begins by highlighting research objectives that the paper intends to test empirically. The section also outlines research design and data collection methodology of gathering empirical evidence and data analysis techniques employed in obtaining results for this study. Moreover, the study discusses a continuum of other relevant research tools appropriate in this section as well.

Case study research design

This exploration employed a case study research design that aimed at critically analysing the role of Sarbanes-Oxley Act, 2002 in the United States corporate firms. However, the case study remained confined to Wal-Mart Company aiming at reviewing the positive and the negative contribution of Sarbanes-Oxley Act of 2002 as perceived by the corporate world. Case study research design has been an integral approach in research and one of the most flexible of all research designs. Central to its application it allows researchers “to retain holistic attributes of real-life situations when investigating empirical events” (Baxter & Jack 2008, p.550). Single case study research design was applicable and integral in the context of this topic since the study was investigating contemporary phenomena where multiple research areas could provide unclear evidence by giving varying results. Under the case study research design, the following objectives were important to evaluate empirically.

Research design approaches

Research design encompasses methodological approaches employed by researchers in a scientific research that involves a comprehensive plan of how the study will conclude its findings (Barringer et al. 2005). This study employed mixed research methodology to comprehend the findings through a combination of the quantitative and qualitative methodologies. Johnson et al. (2007) define mixed methods research as “a systematic integration of quantitative and qualitative methods in a single study for purposes of obtaining a fuller picture and deeper understanding of a phenomenon” (p.119). From the pragmatic perspective as discussed by Creswell et al. (2012), mixed methods applications involves employing diverse approaches from both qualitative and quantitative techniques that consequently give primacy to the significance of the research problem and questions, while remaining valuable to knowledge subjectivity. Prior to employment of mixed research methodological approach in this paper, both qualitative and quantitative techniques had equal significance in approaching the objectives and questions of this study.

Role of Quantitative approach in this study

Methodological research has suggested that combined or mixed research strategies tender the best for both qualitative and quantitative research opportunities, and in this mixed methodology, and quantitative design is integral here. Quantitative research has been among the most functional methodological approaches employed by researchers in the contemporary decades. According to Creswell et al. (2012), “quantitative research is a mode of inquiry used often for deductive research, when the goal is to test theories or hypotheses, gather descriptive information, or examine relationships among variables” (p.4). The study sought to evaluate, appraise, and analyse financial reports including financial statements from the Wal-Mart Company, essential for gathering empirical evidence regarding the research objectives articulated in the research purpose. Baxter and Jack (2008) examine three significant categories of case studies explanatory, exploratory, and descriptive as described by Yin. It is important to understand the form of case study employed in relation to quantitative concerning this study. This dissertation was both quantitative and explanatory in its design and framework.

Explanatory case study, as described by Baxter and Jack (2008), is a form of study that researchers employ while seeking to answer questions that wanted to enlighten the assumed contributory links within real life intercessions that seem excessively complicated for survey or any experimental approaches. Research questions in this study sought to examine the perceived impact of Sarbanes-Oxley Act of 2002 that continues to receive mixed reactions. As explained by Baxter and Jack (2008), descriptive type of case study approach normally aims at describing an issue or phenomenon and the actual context at which it occurs. Financial reports obtained from the organisation would remain complicated to understand if not organised, summarised and discussion using the most understandable means. Organisational reports of financial information from the company provided information mainly in the form of quantity form and thus for this study, quantitative research gave the study an opportunity to draw considerable conclusion by explaining the relationship between figures and numerical data provided.

Role of Qualitative research approached in the study

In undertaking this dissertation, qualitative research techniques under the mixed research methodology was quite imperative to provide a greater insight into the discussion of the problem. As concluded by Creswell et al. (2012), “by including qualitative research in mixed methods, investigators can study new questions and initiatives, complex phenomena, hard-to-measure constructs, and interactions in specific, everyday settings, in addition to experimental settings” (p. 6). The application of qualitative research approach in examining the impact of Sarbanes-Oxley Act, 2002 that involves examining the company’s financial growth aided in comprehending the hard to understand numerical information through descriptive discussion. This move enabled the research to give a complete understanding of a problem in relation to the objectives as qualitative research allowed the researcher to explain numerically presented information in a more simplified. Moreover, combination of qualitative and quantitative methods helped the study to develop multiple perspectives from the stated problem. Two aspects of measuring the impact of Sarbanes-Oxley Act, 2002 was by determining the liquidity and/or profitability of the company.

Data Collection techniques

Data collection is a process that defines activities involved in assembling or gathering research data for analysis and discussion. Data collection techniques therefore entail appropriate or any designated approach used in collecting data for analysis, interpretation, and discussion (Powell 2000). Mixed methodology research was fundamental in acquiring reliable, legitimate, and practical data on two grounds since qualitative and quantitative techniques complement each other. According to Creswell et al. (2012), “there are presumptions that one of the salient strengths of qualitative research is that it focuses on perspective and meaning human lives and knowledge purposely to develop a theory or inductive investigation” (p.7). This development, according to Creswell et al. (2012), is through a “rigorous and systematic form of inquiry that employs methods of data collection through interviews, observations, or even review of prior documents” (p.12). A quantitative technique complimentary through its nature is termed as a mode of inquiry that often employs deductive research by gathering descriptive information or through investigating the relationship between research variables. Triangulation and inductive approaches of data collection were useful in this study.

Triangulation method of data collection

Triangulation is one among the major research practices in the contemporary decades that have proven quite imperative in research by enhancing post-positivism through substantive, assenting and cross validation of data collection protocols, analysis and information interpretation (Bisman 2010). A range of triangulation methods exists in research including theory triangulation, investigator triangulation, between methods triangulation, between studies triangulation and researcher-subject triangulation among others (Bisman 2010). However, in the case of this dissertation, within method triangulation that involves using multiple data resources was significant. Within and between methods triangulation are most critical in a realistic research as both qualitative and quantitative methods can tactfully probe a question (Bisman 2010). This study never involved the use of any data collection instruments such as research questionnaires or interview schedules to gather any practical primary data. Instead, the study relied undertook a triangulation of an assortment of company information including annual financial reports and statements provided by the company that was quite functional in providing empirical evidence needed for the research arguments.

Inductive approach of data collection

Apart from triangulation that simply involved acquiring an assortment of financial data from the company, inductive approaches of data collection played a significant role. According to Thomas (2006), inductive approach in data collection principally purports to compact broad and assorted text data into concise, summarised format that deem easily understandable, subsequently find a clear connection between research purpose/objective and summarised results obtained from the raw data. Of another considerable significance, conducting an inductive approach of data collection enables researchers to develop a better understanding of raw information in the context of the prevailing theories on certain areas under discussion (Thomas 2006). The data triangulated from various company sources could not prove convincing without conducting an inductive approach of data collection. Central to the first objective of inductive data collection, this study employed this approach to enable the researcher summarise and compress assorted company’s financial data of different years to empirically provide an outstanding conclusion regarding the stated research purpose, and thus the study was able to connect the findings to related theories.

Data sources and data collection protocols

Proper documentation of data sources and procedures employed in data collection is a prerequisite in research. Data sources principally mean various information material used to enrich the study with credible facts to reach a conclusion over the stated purpose (Barringer et al. 2005). Data sources in this study involved annual financial report from the company that was reachable through numerous web searches through the company databases. Tugas (2012) asserts that one of the single richest sources of financial analysis comprise of audited financial statements. “The financial statements are usually part of the annual report that listed companies submit to regulatory agencies such as the Securities and Exchange Commission and Stock Exchange entities” (Tugas 2012, p. 174). The study also followed data collection protocols that were essential to ensure the validity and reliability of the data collected from the company. The study collected financial data recorded on an annual basis of a company’s financial performance five years before the advent of Sarbanes-Oxley Act of 2002 and periodically after its emergence to least 2011.

Data analysis techniques

The finalising procedure in methodology that is quite a determiner in ascertaining empirical research before discussing the results and concluding is data analysis. Data analysis is a process that entails critical examination of evaluation objectives that identify topics and domains under investigation, with the entire procedure involving multiple readings and explanation of raw information (Thomas 2006). Concerning this study, qualitative and quantitative data analysis were applicable and those involved a continuum of approaches. According to Tugas (2012), “financial analysis involves comparing the firm’s performance to that of other firms or itself in the same industry and evaluating trends in the firm’s financial position over time” (p.174). In quantitative approach within this study, mathematical techniques known as descriptive statistics helped to evaluate the raw data where numerical counts and percentages were fundamental. Qualitatively, the study involved a discussion of ideas, opinions and perceptions to comprehend the understanding of arithmetical information provided by the annual reports. Analysis began from Wal-Mart yearly financial reports of 1997-2002 and 2006- 2011 annual financial reports.

Data Analysis & Findings

This section of the reports provided a comprehensive analysis of annual financial reports from Wal-Mart Company. The analysis began with analysing Wal-Mart reports of years 1997-2002, before the advent of Sarbanes-Oxley Act of 2002 in the first phase. The second phase of analysis then involved examination of Wal-Mart reports 2006- 2011 annual reports after giving an allowance of four years of its emergence to get its impact. The data analysis section emerged in two distinct parts: part A: An analysis of Wal-Mart 1997-2002 annual reports and part B: An analysis of Wal-Mart 2006-2011 annual reports.

Part A: An analysis of Wal-Mart 1997-2002 annual reports

This section of the analysis part was integral in this study to verify claims of this statement by Centre for Audit Quality (CAQ) (2010) that “the Sarbanes-Oxley Act of 2002 emerged in response to the corporate scandals of the late 1990s and early 2000s” (p. 1). To confirm the claims or allegations posited through this argument, this analysis section wanted to establish a number of accounting problems that could probably justify the presence of fraud cases before the emergence of Sarbanes-Oxley Act of 2002. A continuum of accounting related factors can determine the length of financial fraud in a company through its annual financial statements. Among the breached accounting principles that this study sought to examine are features of financial statement fraud that involved deliberate misstatements, financial statement restatements, overestimation, and underestimation of losses, overstatement of profits among others (Kwasitsu 2004). Simply, inconsistence or financial statement misrepresentation analyses proved significance in this study. The following is a discussion of the above characteristics as examined in Wal-Mart Company.

Financial statement restatements

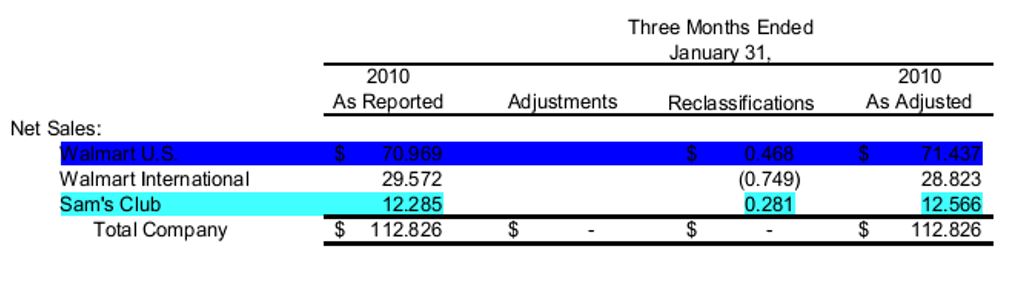

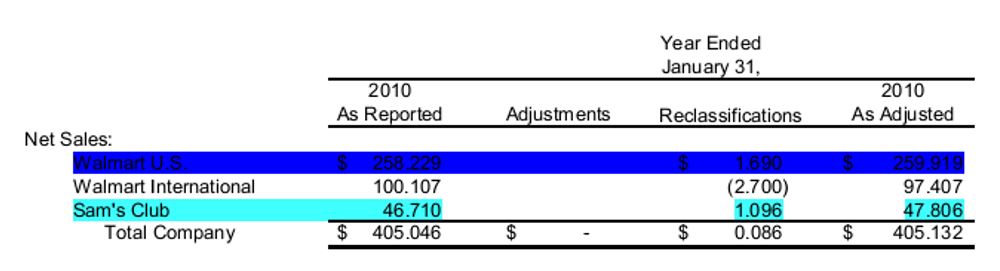

This section of the analysis expected to receive reports involving financial statement restatements that independent and government auditing companies would manage to detect and correct from a series of annual financial reports produced by Wal-Mart Company. Expectations of the research analysis involving an assessment of financial statement restatements hinged upon the notion that the higher the cases of financial statement restatements from external auditors, the higher chances that financial accounting fraud cases existed in Wal-Mart financial statements following probabilities of manipulating figures of accounts that these external audits would manage to correct. Based on the expectations of the researcher from this perspective, more cases of financial statement restatements would emerge before the emergence of the Sarbanes-Oxley Act of 2002. There existed no financial restatements cases that Wal-Mart managed to report before the enactment of the Sarbanes-Oxley Act of 2002. Therefore creating a judgment from cases involving financial statement restatements in Wal-Mart was difficult. Instead, see fig 1& 2: Financial Statement Revisions of 2010.

The two 2010 financial reports of Wal-Mart show slight discrepancies in articulated accounts on the same month. In figure 1, reported net sales for Wal-Mart U.S. in April 30, 2010 indicated $70.969 as reported and afterwards inflated to $71.437, in Wal-Mart International initial figures reported were $29.572 and later deflated to $28.823. Sam’s Club net sales initial reporting figures were $12.285 and later on inflated to $12.566. In another revision of the same month, same year, figure 2, presented this information as indicated. The initial net sales for Wal-Mart U.S. as reported were $258.229, and in the corrected report, the figures inflated to $259.919 through adjustments. Wal-Mart International preliminary net sales in the financial statements indicated $100.107 and afterwards deflated to $97.407, while Sam’s Club which is a constitute business by Wal-Mart reported net sales of $46.710 that magnified to $47.806. From a total of $112.826 to inflation of $ 405.132, this represents $292.306 increment in net sales reported in the same annual financial statement.

Overestimation of profits and underestimation of losses

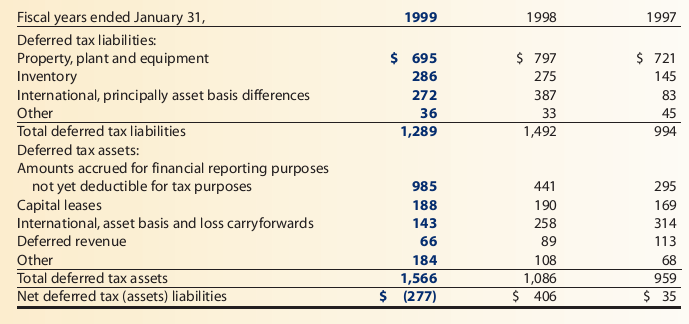

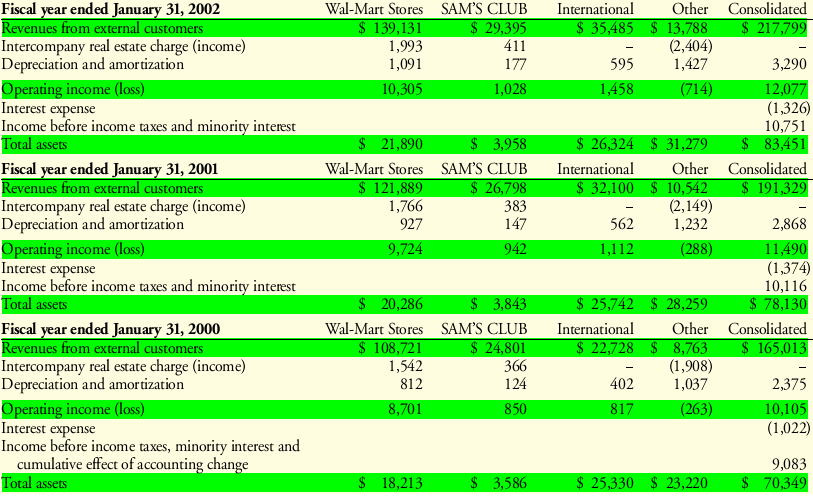

This section was integral in the research as testing figures pertaining to overestimation of the profits and underestimation of a company’s losses can result to somewhat a clear judgment of the existence of fraud evidence in the financial statements. Underestimation of losses and overestimation of profits had possibilities of denoting significant discrepancies and inconsistency in recording financial data that represent manipulation of material financial records to deceive financial statement users. This section examined the trend in losses reporting before the advent of Sarbanes-Oxley Act of 2002 to see whether misreporting existed in the statements. The researcher expected that large gaps and rapid growth in profit and loss margins in the annual financial depict considerable evidence of manipulating accounting transactions over the years. Therefore, this section of the research managed to obtain Wal-Mart reports of 1997-2002 financial years to establish this connection. See figures 3& figure 4.

Losses from the two tables were observable from the following three perspectives. From figure 3, Wal-Mart recorded international, asset basis and loss carry-forwards of $314 in 1997, $258 in 1998 and a record of loss carry-forwards of $143. Wal-Mart recorded a value of property, plant, and equipment of $721 in the year 1997, $797 in the year 1998, and $695 in the year 1999. For the amounts accrued for financial reporting purposes not yet deductible for tax purposes, Wal-Mart reported $295 in the year 1997, $441 in the year 1998, and finally $985 in 1999. Presumably, rapid and constant growth in profit or loss margins has considerable possibilities with inflated and deflated figures to hide certain accounting issues. Generally, from the year 1997 with the financial annual report concluded in the year 1999, Wal-Mart net deferred tax assets that may represent losses amounted to $35 in 1997, $406 in the year 1998, and $277 in the year 1999. This observation indicates that liabilities have been fluctuating over the years.

Figure 4 represents financial data of 11-Year Financial Summary that sums up financial report for Wal-Mart from 2000-2002. All these reports represent data before the enactment of Sarbanes-Oxley Act of 2002. Following information presented in table 4, Wal-Mart managed to acquire revenues from external customers $139,131, Sam’s club received $ 29,395 of revenues, Wal-Mart International obtained $35,485, while other businesses under Wal-Mart obtained $13,788 that sum in a consolidated revenue amount of $ 217,799 in fiscal year that ended January, 2002. In the fiscal year ended January 31, 2000 Wal-Mart stores managed to obtain $121,889 revenues from external customers, Sam’s Club obtained $ 26,798, Wal-Mart international received $32,100, while other businesses under Wal-Mart attained $10,542, that summed up to a consolidated amount of $191,329. Down to the year 2000, Wal-Mart had revenues amounting to $108,721, Sam’s $24,801, Wal-Mart international $22,728, others $ 8,763. This trend denoted that the figures articulated in the revenues seem to fluctuate from one year to another with no evidence of steady growth in figures.

Prevalence of liabilities

Prevalence of liabilities acts as great depicter of financial fraud in financial statements, and how auditors state the figures can reveal evidence of financial fraud. In normal fraud circumstances, understating liabilities reveal a great deal in the accounting tricks (Kwasitsu 2004). This section of the report examined the trend in the occurrence of liabilities as stated in the financial statement of years before the emergence of Sarbanes-Oxley Act of 2002, typically from the year 1997. The dissertation managed to acquire financial data from the year 1997 to at least 2002 involving trends on recordings of the liabilities of Wal-Mart.

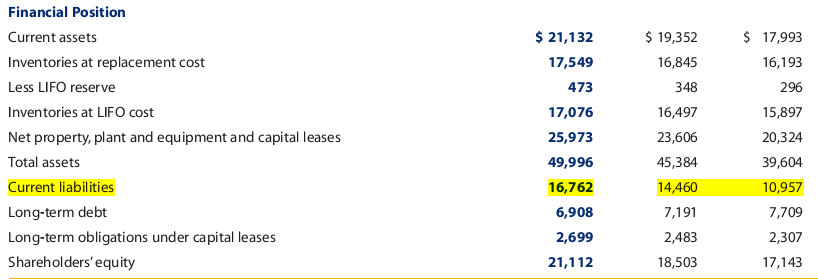

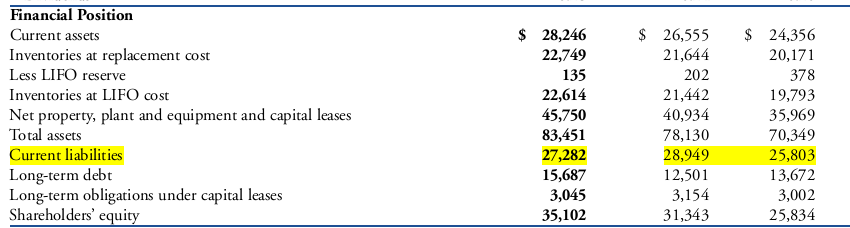

![]()

![]()

According to the information from figure 5, current liabilities for Wal-Mart were $10,957 that later on rose by 24.2% to $14460 and finally grew by 13.7% to an estimated amount of $16762. The year 2000 witnessed a dramatic growth in its liabilities when the figures escalated from $16762 to $25,803 representing almost 35% rise. During the subsequent year, the liabilities escalated to $28,949 that represented 10.8% hike and finally in the year 2002, the figures deflated to $27,282 that represented approximately 2.0% drop in liabilities at Wal-Mart. This trend signifies an inconsistent and fluctuating graph in the figures representing liabilities that indicate no connection of fraud related tricks. Each single drop in the liabilities could motivate auditors to maintain a constant drop as a trick of underestimating of company’s weaknesses.

An analysis of Wal-Mart 2006-2011 annual reports

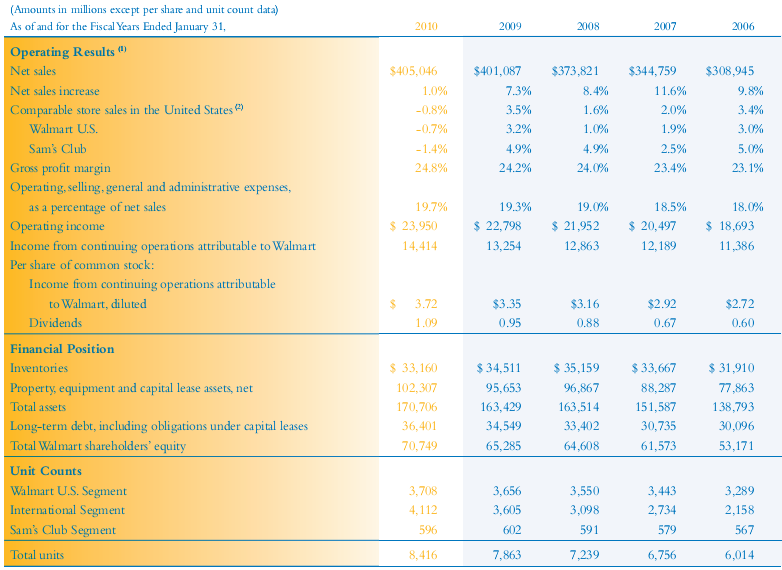

This section sought to analyse annual financial statements from Wal-Mart for the year 2006 that gives an allowance of four years after the enactment of Sarbanes-Oxley Act of 2002 to at least 2011 to examine its impact in these six years. Unfortunately, this dissertation managed to obtain a combined summary of financial data from 2006-2010. Examining trends in presentation of data pertaining to profitability, net sales, firm’s assets, revenues, losses, and even expenses or any of them aided this analysis to conclude on the impact of Sarbanes-Oxley Act of 2002. Table 7 presents information of summarised financial data of annual reports of Wal-Mart for the year 2006-2010.

Net sales from 2006-2010

From the figure above, Wal-Mart managed to record inconsistent net sales with considerable evidence of increase and decrease throughout the five years. In 2006, the company recorded $308,945 with an increase of 9.8% from the previous year, $344,759 in 2007 with an increase of 11.6% from 2006, $373,821 in 2008 with an increase of 8.4%, while $401,087 increase in 2009 with an increment of 7.3% from the previous year and finally, net sales of $405,046 with an increment of 1.0%. This trend clearly presents information that net sales kept fluctuating as opposed to the case where constant growth in sales may depict considerable accounting tricks to impress investors.

Gross profit Margin from 2006-2010

From the same table, information pertaining to gross profit and the trend at which it commences over the five financial years still prevails. In 2006, the company recorded $308,945 with a gross profit increase of 23.1% from probably 2005. In 2007, as aforementioned the net sales were $344,759 that presents 23.4% in gross profit margin. In 2008, the net sales were $373,821 that marks gross profit margin of 24.0% while in 2009, the net sales were $401,087 with a gross profit increase of 24.2 and finally in the year 2010, the net sales recorded were $405,046 that marks a gross margin of 24.8%. This trend indicates a clear and reasonable growth in the gap between the gross profits.

Expenses from 2006 to 2010

In the year 2006, “the company incurred operating, selling, general, and administrative expenses of 18.0% of net sales received and in 2007, the expenses incurred from operating, selling, general and administrative operations were 18.5% of the net sales, 19.0% in the year 2008, 19.3% in the year 2009 and 19.7% in the year 2010” (Wal-Mart Stores Inc. 2010, p.16). These figures indicate a steady but less sharp growth and decline of expenses incurred by Wal-Mart denoting considerable fluctuations in financial statements that unveil the possibilities of the none existence of fraud.

Result Discussion

From an analysis of 1997-2000 and 2006-2010 annual financial reports of Wal-Mart, a clear picture was painted throughout the analysis process. Considering the fact that the dissertation could not manage to obtain information pertaining to crosschecked financial reports that contained unaudited and audited financial data, it was important to examine common factors that depict accounting fraud in a comparison of numerous annual financial reports. Common accounting principles that could denote financial fraud in financial statements included overstating of profits and understating of losses, financial statement restatement, overstating assets, net sales and revenues among other important recording played a significant role in examining the aspect of financial fraud in Wal-Mart. More important is how the trends in the financial statements appeared each consecutive year and the margins that represented figures in these reports. This discussion clearly examines all these issues in relation to fraud.

Deliberate misapplication of accounting principles

Deliberate misapplication or malpractice in basic accounting principles in the financial documents of companies is what this study aimed at examining to justify the significance of enactment of the Sarbanes-Oxley Act 2002. Financial fraud in its broadest meaning can refer to situations where corporations engage in certain accounting malpractices designed to conceal accounts of the company normally practiced by accounting officials with the aid of other top officials employed by the investors. Financial documents are normally difficult for investors and corporate owners to understand and a line of accounting professional can build a mutual network to deceive top organisation officials. Misrepresentation of events, accounts, transactions, inflation, and deflation of the information pertaining financial statements, outright falsification, omission of important account information, material intentional omission among several other factors are practices that indicate accounting tricks that denote fraud intentions. In addition, breaching of policies, principles and procedures governing measurement, recognition, reporting and disclosure of economic events or any business transactions represent significant evidence of financial fraud.

Aspects of financial statement restatements

An examination of the aspect of financial statement restatements in Wal-Mart could paint a clear picture of how auditors misrepresented important information in the financial statements. Unfortunately, there was no clear connection between the advent of Sarbanes-Oxley Act of 2000 in relation to most accounting issues practiced by Wal-Mart. The researchers initially expected to find a series of cases relating to financial statement restatements or financial statement revisions in Wal-Mart before the emergence of Sarbanes-Oxley Act of 2002. Nonetheless, the dissertation managed to acquire reported cases of financial statement revisions in 2010, almost eight years after enactment of the act. In fact, the report that provided this information claimed that these, “these revisions are generally the result of changes in the alignment of segment operations or cost allocations designed to drive greater accountability” (Wal-Mart Stores Inc. 2010). By such revisions appearing after the enactment of the Sarbanes-Oxley Act of 2002, mean that these practices regarding financial statement restatements had nothing to do with the impact of the act.

Concepts of overestimation of profits and underestimation of losses

It was quite significant to examine trends in profit and loss statements. According to Kotsiantis et al. (2006), financial fraud statement fraud may comprise purposeful omission of amounts or misstatement of important figures. A clear examination of analysis of annual financial reports of Wal-Mart prior to the emergence of Sarbanes-Oxley Act of 2002 subsequent to its enactment revealed quite a significant evidence of lack of any reasonable impact on bigger firms. Throughout the analysis of financial reports documented before enactment of the act, a clear picture was emerging from the concept of overestimation of the profits and underestimation of losses. A closer examination of all reports analysed before and after the enactment of Sarbanes-Oxley Act of 2002 by this dissertation revealed that there were fluctuations in recorded figures, with considerable gaps in growth and decline of profits. Sharp growth in profits for each successive year could depict a clear indication of accounting tricks employed by managers and accountants to meet the expectations of each financial year.

Firm revenues, net sales, liabilities and others

Inflation of net sales, understatement of liabilities, and other practices were core principles that this study wanted to examine before and after the enactment of the Sarbanes Oxley Act of 2002. A closer examination of annual financial reports documented prior to the enactment of the act in Wal-Mart indicated that firm revenue was appearing in a fluctuating manner either on the rise or sometimes on fall in-between the years before and after the act. Similar trends in the appearance of annual net sales were evident throughout the analysis, with inflation and deflation in the figures representing annual net sales appearing in an unpredictable manner. There was no evidence to reveal that accountants, auditors of any of the financial officers in Wal-Mart practiced accounting tricks following the information on liabilities of the firm in the two periods of analyses. Figures representing liabilities of the firm either grew in small gaps between the financial years or depreciated considerably each successive year presenting unpredictable graph that auditors could manage to manipulate.

Conclusion and Recommendations

Conclusively, the dramatic emergence of Sarbanes-Oxley Act of 2002 has become a constant argument between analysts, lawmakers, and even researchers with different notions streaming from different ends. This analysis presented quite a significant and elaborate analysis of annual financial reports of Wal-Mart prior and subsequent to the advent of Sarbanes-Oxley Act of 2002. Wal-Mart has been trading higher in America as one of the top corporate that ranks top in recent Fortune 500 businesses. Before then, Wal-Mart was among top corporate organisations over the years even before the emergence of Sarbanes-Oxley Act of 2002. The possibilities that this analysis could depict financial fraud in this organisation therefore were minimal given its unending performance records over the years. Presentation of information linking financial data gathered from the financial reports revealed considerable evidence that the emergence of Sarbanes-Oxley Act of 2002 had little or to some extent no significant impact on most of the Fortune 500 firms that probably have been demonstrating outstanding performances over the years.

The greatest challenge of this report rested upon acquiring credible information pertaining to annual financial data pertaining to Wal-Mart that could best suit a comparative analysis of the years before and after the enactment of the emergence of Sarbanes-Oxley Act of 2002. All firms would like to gain a positive reputation from the public and posting sensitive data that could raise questions about organisational competence is normally a rare occurrence. Therefore, enactors of Sarbanes-Oxley Act of 2002 should make available information about their auditing in any organisation to enable the public understand better how organisations are fairing with the Act. Organisations produce information that hides certain reality in the firms. For instance, the reasons given by Wal-Mart for financial statement restatements were not justifiable and the researcher had no better way to conclude on this issue.

Reference List

Barringer, B, Jones, F & Neubaum, D 2005, ‘A quantitative content analysis of the characteristics of rapid-growth firms and their founders’, Journal of Business Venturing, vol. 20, pp. 663–687.

Baxter, P & Jack, S 2008, ‘Qualitative Case Study Methodology: Study Design and Implementation for Novice Researchers’, The Qualitative Report, vol. 13, no. 4, pp. 544-559.

Bisman, J 2010, ‘Post-positivism and Accounting Research: A (Personal) Primer on Critical Realism’, Australasian Accounting Business and Finance Journal, vol. 4, no. 4, pp.3-25.

Castro-Wright, K et al. 2013, Wal-Mart 2010 Annual Report. Web.

Centre for Audit Quality 2010, Deterring and detecting financial reporting fraud: a platform for action. Web.

Creswell, R et al. 2012, Best Practices for Mixed Methods Research in the Health Sciences. Web.

Harvey, P 2010, Wal-Mart 1999 Annual Report. Web.

Johnson, B, Onwuegbuzie, A & Turner, A 2007, ‘Toward a Definition of Mixed Methods Research’, Journal of Mixed Methods Research, vol. 1, no.2, pp. 112-133.

Kotsiantis, S, Koumanakos, E, Tzelepis, D & Tampakas, V 2006, Forecasting Fraudulent Financial Statements using Data Mining’, International Journal of Computational Intelligence Volume, vol. 3, no. 2, pp.104-110.

Kwasitsu, D 2004, Financial Statement Misrepresentation: Could Investors Detect It? Web.

Powell, E 2000, Analysing qualitative data. Web.

Thomas, R 2006, ‘A General Inductive Approach for Analysing Qualitative Evaluation Data’, American Journal of Evaluation, vol. 27, no. 2, pp. 237-246.

Tugas, F 2012, A Comparative Analysis of the Financial Ratios of Listed Firms Belonging to the Education Subsector in the Philippines for the Years 2009-2011, International Journal of Business and Social Science, vol.3, no. 21, pp.173-190.

Wal-Mart Stores Inc. 2010, Adjusted Financial Reports for the Three Months and Year Ended January 31, 2010. Web.

Walton, S et al. 2013, Wal-Mart Annual Report 2002. Web.