Introduction

Southwest Airlines is a global low-cost carrier based in the United States. It was founded about four decades ago in Dallas, Texas. Its operations cover about 97 cities both within and outside the country. Transporting more than 120 million passengers annually, it is one of the leading domestic carriers in the United States. The airline company has sustained a solid growth despite a chain of struggles and severe losses that resulted from the September 11 terrorist attacks. Southwest Airlines recovered quickly while other carriers reduced flight schedules besides retrenching some of their staff to remain profitable. The introduction of new nonstop routes and the development of corporate culture and public image has continued to underpin the airline’s steady growth over the years. However, the airline faces a number of airport and airspace constraints that have challenged its swift growth. This case study provides insight into Southwest Airline’s airport capacity and airline congestion with a view of discussing possible solutions that will enable it to accommodate predictable growth in its hubs both within and outside the United States.

Identifying the Southwest Airline’s Problem

A number of factors such as airport hubs, mixed traffic, demand, availability of routes, and runways are taken into account when delving airspace-related issues. There is a need to establish whether Southwest Airlines has hubs that are close to major cities. Could fly Boeing 737s exclusively be creating a problem for the airline? On the other hand, the examination of airport problems demands the analysis of the relationship between taxiway interruptions on departure and airborne holding intervals. In this analysis, workload metrics are also important in the examination of traffic density in hot spots. Using these deductions, it is realized that Southwest Airlines is encountering a number of challenges that have limited its growth. Operating in over 52 airports and with about 2600 daily flights, the carrier will in due course flood its historic niche. The company’s long-standing strategy to concentrate on favorable flying climate zones and less congested airports is predicted to create problems in the near future.

Airport Demand as it relates to Current Capacity

The United States airline industry is experiencing high demand and increasing profitability. In spite of unpredictable conditions and dynamic organizational environments, Southwest Airlines is continuing to prosper. Recent statistics show that the carrier’s traffic increases by approximately 7.2 percent annually. This value is higher than its current capacity which grows by about 4.9 percent year-over-year. This data is an indication that traffic growth has greatly improved since it has topped the airline’s present-day capacity. Increased performance is also reflected in its stock movement. In 2016, its traffic increased by 6.4% higher than capacity growth which stood at 5.8% (Sikes & Gomez, 2016). In 2015, the carrier’s traffic had only increased by approximately 9% higher than it’s capacity growth of 7.3% year-over-year. In spite of this trend, the International Air Transport Association predicted that the airline industry might be realizing the climax of traffic lift due to unstable oil prices (Sikes & Gomez, 2016). This situation is anticipated to slow down travel demand, which is likely to reduce the profitability of airlines. Nevertheless, irrespective of the slowing demand, Southwest Airlines has an added advantage over its rivals, perhaps due to its low-cost model (Wittman, 2014). Previous trends show that increased gross domestic product together with decreased prices will continue to intensify traffic for the carrier.

Exploring the Problem, including Cause and Effect

What is Generating Demand?

Various factors in the flight industry are generating demand in Southwest Airlines. Despite the slowed travels in 2016, the first quarter of 2017 has indicated an increase in air tickets owing to the booking of eleventh-hour flights. Being the largest discounter in the United States, the Southwest Airlines Company is presently accruing higher profits from increased demand and good air ticketing rates since late 2016. Last-minute tickets, particularly amongst business travelers, have also boosted sales for the airline. Another factor that is currently generating demand for the airline is its longstanding point-to-point strategy, which is underpinned by the low-cost business model. This plan allows it to offer relatively shorter routes and reduced travel and wait times for its vast customer base. The strategy has also lowered average air ticket costs. By adopting the low-fare revenue model, Southwest Airlines benefits from a high-density seating arrangement that decreases the need for provisions such as washrooms, which are indispensable for long travels. The implementation of this model has resulted in lower fares, which have created a demand for the airline. In addition, Southwest Airlines has kept up with demand by improving its load factor. Recently, the company increased its fleet volume by 7 percent. It has also ensured continued competence of the existing airplanes. This plan has generated significant demand for the airline.

Historical Growth Trend

The commercial airline industry in the US has been characterized by boom-to-bust cycles since its deregulation in 1978 (Federal Aviation Administration, 2016). The growth trend for the Southwest Airlines Company is rather cyclical. After incorporation in 1967, the company underwent a sequence of regulatory challenges that prompted a number of changes in its business strategy (Nicas & Carey, 2014). In 1971, the carrier completed an IPO of 650,000 stockholdings at $11 per share and began offering customer services the same year. Although its early years exhibited sluggish growth and operating losses, the company realized ground-breaking traffic statistics in the 1980s reflecting 28 percent upsurge in revenue passenger miles (RPM) (Hawkins, Misra, & Tang, 2012). It also achieved a 20 percent increase in traveler boarding. The induction of new services in about ten airports and the acquisition of additional Boeing 727-200 and 737-300 aircraft in 1980 enabled the carrier to remain at par with its expanding business (Nicas & Carey, 2014).

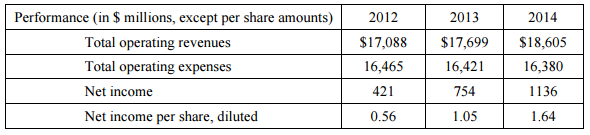

In the 1990s, the company focused on instituting corporate culture and improving public image. This plan leads to steady growth and it was ranked among the top hundred best companies in America by Fortune magazine in 1977. The volatility of markets and great recessions from 2007 to 2009 continued to shape this industry with carriers such as Southwest Airlines adopting low-cost operations, abandoning unprofitable routes, and grounding less efficient aircraft to decrease losses. In 2011, Southwest Airlines merged its operations with AirTran Airways with a view of expanding overseas markets. The acquisition of this carrier increased its operating revenues by approximately 29.4 percent.

In 2014, the company fully integrated AirTran international services into its system. This accomplishment saw the company begin servicing AirTran’s international networks using its aircraft (Simmons, 2015). Operating revenues from AirTran increased to about $226 million in addition to $18.6 billion accrued from domestic operations within the US. Due to these business changes, the company achieved a record-breaking estimated profit of $1.4 billion. Today, Southwest Airlines Company has moved into more crowded and relatively expensive airports, overcoming barriers of distance and time. The company’s business travel outlay is anticipated to rise by 50 percent by 2020 (Federal Aviation Administration, 2016).

Level of Growth as the predicted by FAA

The United States Department of Transportation’s Federal Aviation Administration (FAA) forecasts continued, steady growth in air travel. Studies indicate that the aviation industry moved from boom-to-bust cycles to profit sustainability. The economy is just recovering from the most treaded economic recession in history that slowed business expansion. As a result, the aviation industry is expected to experience unprecedented growth for over twenty years. According to the Federal Aviation Administration (2016), the US passenger volume is anticipated to grow by about 2.1% annually. System traffic in revenue passenger miles (RPMs) is forecasted to rise by about 2.6% annually up to 2036. The United States available seat mile (ASMs) is expected to increase with growing demand. Despite the minimal fleet growth, the overall number of aviation hours is likely to rise by about 1.2% each year up to 2036 (Federal Aviation Administration, 2016; Sikes & Gomez, 2016). In line with these expectations by the FAA, Southwest Airlines Company is planning to purchase more aircraft to increase its regional and international fleet. This situation will intensify its traffic and congestion in airports and hubs. However, large and medium hubs are also expected to grow together with increasing demand owing to their inclination to profit-making (Federal Aviation Administration, 2016).

Possible Solutions or Resolutions Planned/in Place

How Southwest Airlines’ Airport Hubs will accommodate this Predicted Growth

In the wake of increasing demand, traffic, and airport congestion, Southwest Airlines has various plans in place to expand its international operations while sustaining profitability, customer focus, and good public image (Lonzius & Lange, 2017). Since the completion of its merger with AirTran in 2014, the company has launched a number of flights to international destinations such as Jamaica, Aruba, and Barnabas among other countries (Lonzius & Lange, 2017; Le, 2016). This plan is continuing to intensify the firm’s global presence. The carrier is also establishing additional hubs in high domestic presence destinations such as the Houston Hobby Airport. In this facility, the airline will operate four out of the five available gates (Lonzius & Lange, 2017). In addition to establishing new transnational flights, this hub will have a great significance to the company’s fleet capacity and traffic.

Following the predicted growth by the FAA, Southwest Airlines also plans to increase its services in fifty new global markets through the Baltimore and Fort Lauderdale Airports, which is rare among the company’s busiest hubs (Lonzius & Lange, 2017; Nussbaumer & Revels, 2016). This strategy is in line with the company’s objective to grow its revenue over the next few years. The completion of its merger with AirTran has also increased its hubs, which will supplement its point-to-point structure (Le, 2016; Fageda & Flores-Fillol, 2016). Overall, the airline will need to add the capacity of its airport hubs or establish new ones while ensuring efficiency to restrain congestion. Another way of ensuring reduced crowding and traffic is by regulating the types of aircraft that are used for operations. In this case, the airline should sustain its low-fare revenue model, which benefits it from the high-density seating arrangement.

References

Fageda, X., & Flores-Fillol, R. (2016). How do airlines react to airport congestion? The role of networks. Regional Science and Urban Economics, 56(1), 73-81.

Federal Aviation Administration. (2016). FAA aerospace forecast: Fiscal years 2016-2026. Web.

Hawkins, O., Misra, R., & Tang, H. (2012). Southwest Airlines Co. Web.

Le, H. B. (2016). An empirical analysis of the price and output effects of the Southwest/Airtran merger. Competition and Regulation in Network Industries, 17(3-4), 226-240.

Lonzius, M. C., & Lange, A. (2017). Robust scheduling: An Empirical study of its impact on air traffic delays. Transportation Research Part E: Logistics and Transportation Review, 100, 98-114.

Nicas, J. A. C. K., & Carey, S. U. S. A. N. (2014). Southwest Airlines, once a brassy upstart, is showing its age. The Wall Street Journal, 1(04), 2014.

Nussbaumer, H., & Revels, M. (2016). US airports’ perspective on airlines’ fleet mix and its impact on capacity. Journal of Airport Management, 10(2), 168-179.

Sikes, J., & Gomez, A. (2016). Southwest Airlines Co. (LUV). Web.

Simmons, G. (2015). Does hedging reduce risk? Analysis of large domestic airline. Journal of Business Strategies, 32(1), 1.

Wittman, M. D. (2014). Are low-cost carrier passengers less likely to complain about service quality? Journal of Air Transport Management, 35(1), 64-71.