Introduction

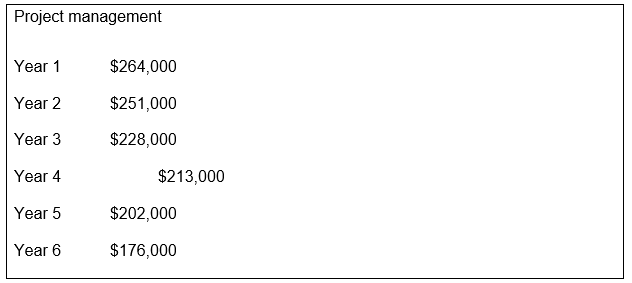

Before a company invests in a certain project, there is a need to interpolate the project. This is meant to ensure that a company invests in a viable project. There are different methods to interpolate the viability of a project; they are the Average rate of return, Net present value and payback method. This method analyzes Sky’s project using the above methods. The cash outflow of the project is $900,000 and the inflow is as follows;

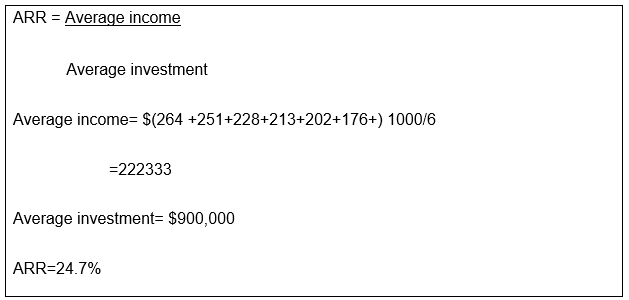

Average rate of return (ARR)

This method utilizes average income after tax by average investments, then expressed as a percentage. The rate is then compared to banking rates. If the rate of return is high then a project is viable. In this case;

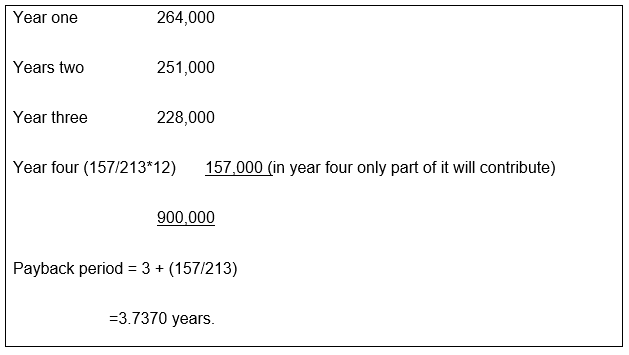

Payback period

The method analysis the time taken for a project to recoup the investment that was initially put; in our case, the investment is $900,000; when the income equals to this amount is the payback time When comparing two projects one with a short payback time is considered better than one that does not have.

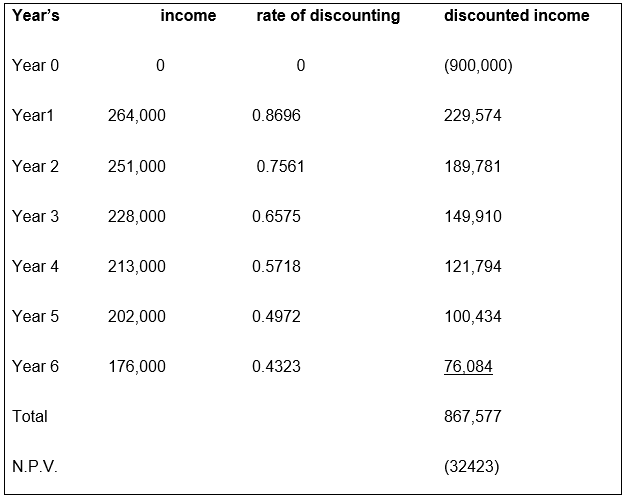

NPV using a hurdle rate of 15%

The NPV method considers the time value of money by discounting the expected income from a project. If the discounted amount is less than the initial capital outlay then the project is not viable. When discounted inflow is equal to outflow, then the project will be viable but without any profit gain to the developer. If NPV is higher than zero then the project is viable. When using this method to compare more than one project, the project with the highest NPV is the most viable.

It is calculated as follows;

Should Sky make this investment?

Sky should not invest in the project since the discounted rate of return (NPV) which shows a more accurate calculation of the value of money is negative. This shows that at the end of the period, the company will have suffered a loss. The minimum value of NPV for a viable project has an NPV equal to Zero. This means that at the end of the project period it will cover the initial capital that was invested. This is not the case in Sky’s project.

Assuming the equal cash inflow each year is equal, what is the minimum annual cash flow for Sky to accept this project?

Let’s take the equal cash flow to be equal to X, Then at the minimum rate then NPV=0 (this means that the project brings Zero profit to the company).

When NPV=0 then the discounted inflow is equal to initial investment; we have;

0.8696X + 0.7561X + 0.6575X + 0.5718X + 0.4972X + 0.4323X = 900,000

3.7845X=900,000

X=232,812

For Sky to invest in the project, the project should give an equal amount of revenue at $232,812 per year.