Major Trends in the Data

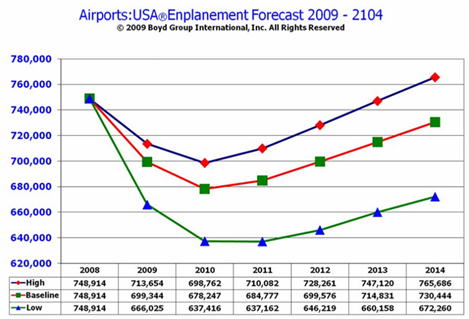

Enplanement

Passenger aircrafts

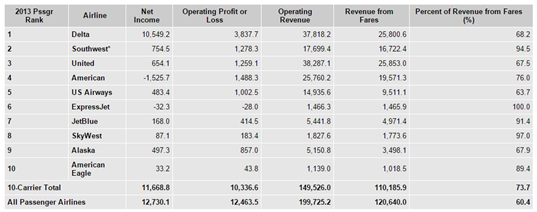

Annual airlines financial report

Annual large airline revenue and net income

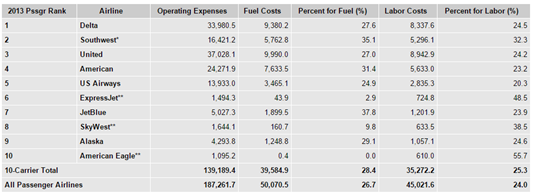

Annual large airline expenses

Responses to challenges

As a major contributor to global economic stability, the airline industry faces several challenges. The first major challenge faced by the industry is the rising fuel prices. The present state of the industry has been significantly molded by fuel prices. Currently, a barrel of oil retails for about $120. The price is expected to rise even further. The political instability in oil-rich countries and increased demand explain the anticipated increase in price. Airline companies in the industry have responded to this challenge by hedging against escalating oil prices. Some airlines have also constructed their refineries.

The second challenge is the global economic crisis. The inability of governments to resolve the Euro debt crisis has affected the current and future profitability of the industry. This can be attributed to the fact that the industry is capital intensive, and the players rely on loans to finance their operations. Companies in the industry have reduced the amount of debt as a way to reduce the effects of the debt crisis. Another challenge faced by the industry is competition between low-cost carriers and contemporary aircraft. This has resulted in cheap flights. As a response to this challenge, the traditional carriers have made several customer-focused enhancements.

This has enabled them to compete well. Besides, the industry has resorted to focusing on cost-cutting to maximize the number of seats. Another challenge faced by airline companies is security threats such as the 9/11 attacks. These security concerns have caused companies to increase costs related to security procedures and additional expenses. The industry has countered these challenges by increasing charges for various services (Reed, 2014).

Discussion of the major trends

The information presented in the data above shows that there was a decline in the number of passengers between 2008 and 2010. This can be attributed to economic instability. From 2010, the number of boarding passengers increased. Despite the global recession, the number of passenger aircraft increased from 17,942 in 2009 to 19,160 in 2012. It can be noted that the number of passenger aircraft to North America declined in 2010 and 2011.

The financial report for the industry indicates that there was a dismal performance in terms of revenue earned between 2009 and 2012. This can be attributed to some of the challenges discussed above. In 2013, the industry reported a significant increase in revenue. A comparison of the three airline companies which are Delta, South West, and American shows that Delta reported the highest amount of revenue, expenses, and net income followed by Southwest and American.

The U.S. airline industry is quite perplexing, vibrant, and diverse. The industry has evolved tremendously since the first organized commercial flight in 1914. The industry has grown by about 5% annually since 1945. Also, it has over 100 certified passenger airlines. The US market contributes over one-third of the world’s air traffic. Recent statistics show that commercial airline contributes about 8% of the gross domestic product (GDP).

Airline Industry Threats and Opportunities Analysis

The US airline industry operates in a very dynamic market with a series of demand and supply factors operating within it. This part of the paper discusses the threats and opportunities of the US Airline Industry within which the SWA, Delta, and American Airline operate.

The Threats

Even though the US airline industry is endorsing the colossal expansion, the airline market still suffers from a huge demand-supply fissure as a result of prompt growth of other international airline industries and the rapidly dwindling population of travelers. For instance, there is a rapidly growing aging population, which has reduced the demand for air travel since the age population consists of 30 percent of the annual passengers.

Over the years, the US government has increased its interventions in the airline industry as a strategy of protecting passengers from unethical airlines. Besides, the interventions have been in the form of a bailout to specific airlines while ignoring the relatively small airlines. As a result, it becomes very difficult for the airlines to compete on an equal playground. For instance, the three major players such as the SWA, Delta, and American Airline have their prices regulated by the government despite the challenges of the increased cost of operations.

Another threat to the survival of the US airline industry is the spiraling costs, which have the effect of decreasing the potential market by a significant margin. In the last ten years, the cost of fuel, planes, and the logistics of operations has been rising in unequal proportion to the air tickets and taxes. The rising costs have decreased the potential market by a sizable margin to an extent that some airlines have resorted to cutting down their labor force, partnering with other airlines even when the returns from such partnerships are not favorable, and introducing economy classes which have very minimal returns.

In the US airline industry, there are competing interests as a result of global health and terrorism challenges. For instance, the US airline industry has been forced to cancel its West Africa and part of Middle East markets due to threats of Ebola and terrorism, respectively. These threats have long and short-term negative impacts such as reduced demand, which translates to reduced profits. For instance, there are clear indications that the performance of airlines within the US airline industry may drop by ten percent following the reduced demand from the Middle East and African markets (Boyd Group International, 2009).

Potentials for growth in the US airline Industry

The industry boasts of internal capabilities that have seen it take a prominent position in the global airline market as the leading industry. With the increasing demand from non-traditional markets such as chartered airlines and luxury travel, the US airline industry is positioned to survive the market dynamics and expand further to satisfy the new markets.

Due to the stability of the economy and the government’s commitment to promoting investment through accommodating trade policies, there is an increased appetite for investment in the US airline industry as evidenced by a series of new partnerships and trade agreements. In addition, foreign investors are finding it more attractive to collaborate with local investors who have better knowledge of the US airline industry.

The investors in the US airline industry have access to modern technology and experience in domestic markets and international markets. The growing technology and expanding domestic market may boost the potential growth of the industry in the short-term and long-term. Moreover, the current sophisticated technology has greatly assisted in blending the old ideas and the new ones to create great results for the benefit of all players in the industry.

References

Boyd Group International. (2009). US airline industry trend forecast. Web.

Reed, T. (2014). Delta, leader of the U.S. airline industry, challenges Boeing and export-import bank. Web.

United States Department of Transportation. (2014). 4th– quarter and annual 2013 airline financial data. Web.